What is Suitability? Back to the table of content

The concept of “Suitability” measures the degree of adequacy of an investment advice or a portfolio management service to the client’s financial knowledge and experience, his financial situation, his financial objectives and his risk profile. All in all, suitability is a simple, straightforward concept which boils down to common sense: as an example, it would be most ill-advised to invest the entire fortune of a 90-year old pensioner in commodities derivatives.

Suitability has become unavoidable in financial circles following the 2008 subprime crisis and the scandals that have unfolded since. Unsurprisingly, it has now become one of the main requirements with financial regulators (LSFin in Switzerland, MiFID in the European Union, Dodd-Frank in the United States).

The concept of suitability stretches far beyond finance and applies to a number of fields. The table below sets out an illustration and a comparison with medicine.

| Stage | In medicine | In finance |

|---|---|---|

| What is the diagnosis? | Symptoms, patient examination (patient medical history, blood samples, allergies) | Personal situation of the client, his financial and tax status; financial knowledge and experience of the client, restrictions, objectives, risk perceptions |

| What are we aiming for? | Treating the patient’s symptoms (lowering blood pressure, lowering blood sugar level, treating an infection, …) | Fructify the client’s capital whilst considering one of the following constraints:

|

| What is the prescription? | Selection of a treatment (medication, physiotherapy, chemotherapy, …) and define specifics in terms of dosage, frequency | Selection of the appropriate financial instruments and portfolio construction (weightings, tactical adjustments, …) |

| What are the risks? | Ineffective treatment; that is, no improvement of the patient’s condition

The patient’s condition improves but is subject to side effects The patient’s condition worsens Impacts on the reputation of the medical professional; lawsuits, calls for disqualification |

The set of objectives were not met (i.e. did not outperform a benchmark)

The set objectives were met but certain client’s restrictions were not respected Losses are more significant than planned Impacts on the reputation of the financial professional (lawsuits, calls for disqualification) |

Our Approach Back to the table of content

Step 1: Assessing the client’s risk profile

QuantPlus has developed a tool that analyses the various components of the client’s risk profile, including psychological factors.

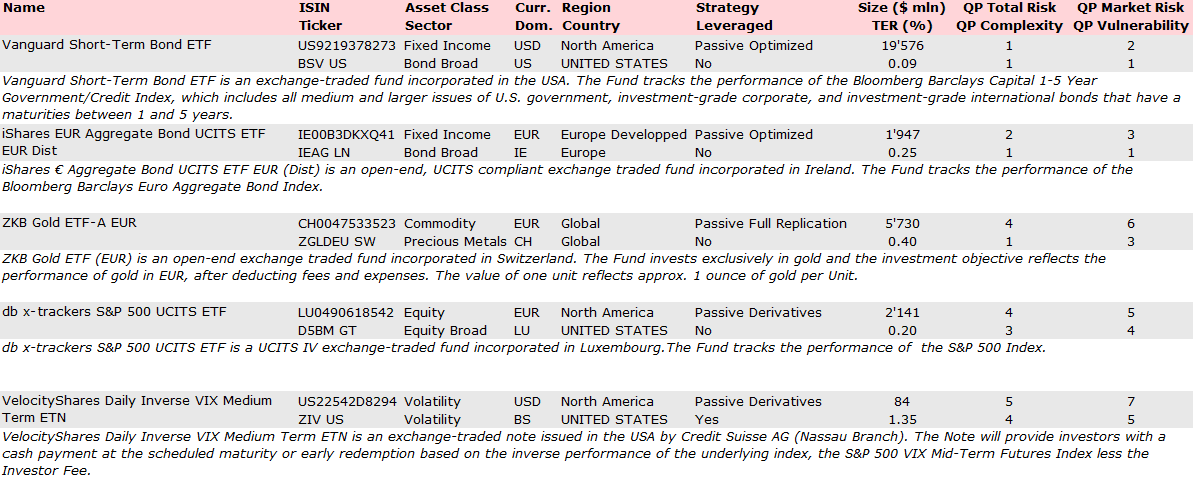

Step 2: Define a vulnerability indicator for each financial instrument

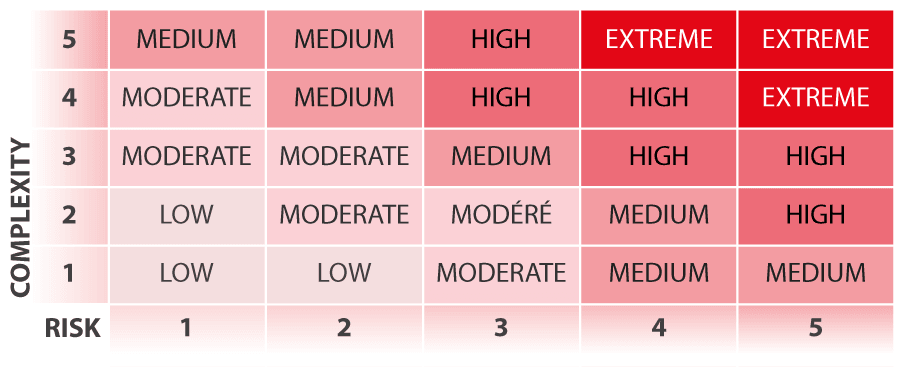

QuantPlus works out this indicator using the risk factors and the level of complexity of each financial instrument. As a result, the financial instrument selected will find its place in our vulnerability matrix which is shown below.

Step 3: Match up and align the client’s risk profile to the vulnerability indicators of the instruments that make up the client’s portfolio

QuantPlus achieves this by setting limits on the weightings for each cell of the matrix according to the client’s risk profile. As such, our 90-year old pensioner will only have a very limited exposure to commodities derivatives, or even none.

Some Examples Back to the table of content

The examples below illustrate our approach when it comes to ETFs, although this method can also apply to other financial instruments.